Stock market history is the blueprint for finding tomorrow’s stock market winners today

The stock market winners of yesteryear tell us how to find the next stock market leaders.

To the right is a table of some of the most recognized stocks in America during the 1990’s with their annual stock growth rates and profit growth rates.

Stocks with the best profit growth rates are listed on the left. Notice each stock on the left also had a better stock growth rate than every stock on the right. This research points to profit growth driving stock growth. By investing in companies with the best profits, we end up having great stocks. Profit growth leads to stock growth.

Also, the companies with the highest rate of profit growth each year – Cisco (CSCO) and EMC (EMC) – gave their investors some of the best returns on their money. So the faster the profit growth, the better the stock growth.

The Best Stocks Fit the Mold

David Sharek has always been intrigued by stocks that made the biggest gains. His first four years as a stock broker (1999-2002), he spent countless evenings researching the biggest winners of the past year, trying to spot trends — characteristics — the best stocks had. He not only wanted to know what caused these stocks to take off to stratospheric heights, but how he could devise a way to find the future winners beforehand.

David Sharek has always been intrigued by stocks that made the biggest gains. His first four years as a stock broker (1999-2002), he spent countless evenings researching the biggest winners of the past year, trying to spot trends — characteristics — the best stocks had. He not only wanted to know what caused these stocks to take off to stratospheric heights, but how he could devise a way to find the future winners beforehand.

He started uncovering secrets only the smartest minds in the money management business knew; ones they shrewdly kept to themselves. Eventually, he was able to spot the pattern, or theme, many superstar stocks possessed. From Xerox (XRX) during the 1960s to Starbucks (SBUX) during the 1990s, most of the great stocks had lots in common as they trounced the market. It was as if they were all poured from the same mold.

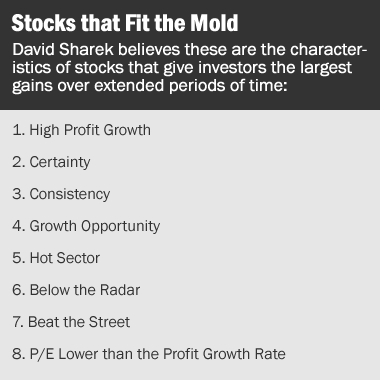

Armed with this knowledge, David found one stock after another that “fit the mold.” and built a portfolio compiled strictly with potential superstars. He believes these are the characteristics of stocks that give investors the largest gains over extended periods of time, traits of companies that fit the mold.

Characteristics Top Stocks Possess

- High Profit Growth – The most important factor affecting the long term performance of a stock is the company’s profits. In the simplest terms: stock growth follows profit growth. Over the long-run a stock’s growth rate is often similar to the company’s profit growth rate.

- Certainty – Stocks have personalities, just like people do. Some you can trust, others you can’t. Certainty means there is confidence the company will be able to make their estimated profits. An industry like healthcare has more certainty than a sector like oil, which is up-and-down due to the price of oil and the state of the economy.

- Consistency — The best stocks grow profits consecutively every year. Each time annual profits are up, the company is proving its success, year after year. It’s dependable, consistent. The cream of the crop companies will grow profits each year and not incur a down year in profits.

- Growth Opportunity – Once the stock has passed the tests of certainty and consistency, David looks into the future and imagine how big the company will be years from now. Companies with the ability to compound in size have growth opportunity.

- Hot Sector – The premier stocks often come from the best sectors at the time. These sectors often have an easier time growing profits rapidly due to forces in the economy.

- Below the Radar — Many people like to own what they know, but it pays to find small, unknown stocks nobody knows about. Buying a stock before everyone else knows about it gets you in on the ground floor. Any new familiarity with the stock brings more prospective buyers. If more people want to buy the stock than sell the stock, the share price goes higher.

- Beat the Street — The best stocks beat earnings estimates while making their biggest runs. They underpromise and overdeliver. These companies also raise earnings estimates after reporting last quarter’s profits.

- P/E lower than Profit Growth — Together, a stock that has a low P/E and high profit growth can be a powerful combination. The stock is sometimes forced up, because the company could eventually make in a year what the stock is currently selling for.